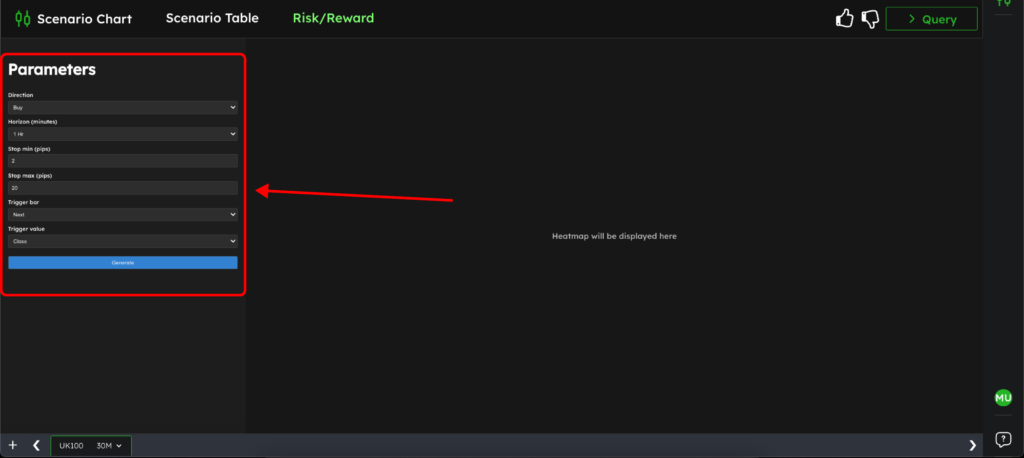

To access the Risk-Reward Matrix, click the Risk-Reward button located in the top navigation bar. This will open a blank screen with the Parameters window on the left-hand side.

To begin using the Risk-Reward Matrix, you need to define several key parameters:

This allows you to define where to start your analysis based on the scenario bar (the bar with the “S” above it).

Once you’ve set your parameters, click Generate, and the matrix will be created.

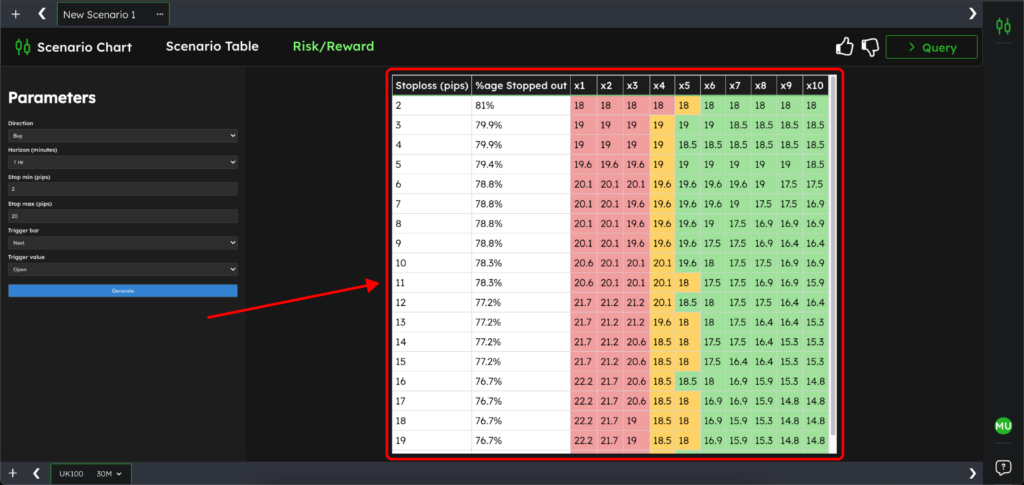

Once your matrix is generated, you’ll see a table that shows the potential outcomes based on the parameters you’ve set. Here’s how to read and understand the different elements of the matrix:

Join the TradrLab® newsletter to stay ahead with industry insights, expert tips, and the trading knowledge you need to sharpen your edge