Here are their dictionary definitions 👇

Possibility: “A thing that may happen or be the case.”

Probability: “The quality or state of being probable; the extent to which something is likely to happen or be the case.”

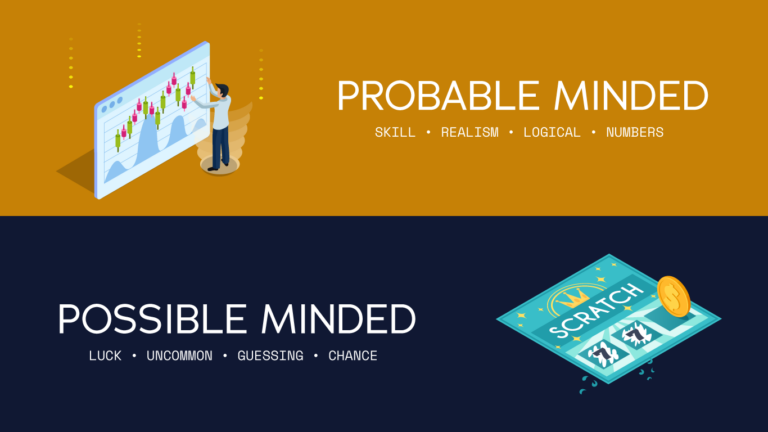

Most traders don’t know that they have a possibility mindset.

It’s a mindset where your trading decisions are based on “what ifs”.

What if:

- The price goes up 1000 pips.

- Bitcoin goes to $100,000 next week.

- The price goes into profit after hitting my stop loss target.

These hypothetical scenarios can happen — which is dangerous.

Possible scenarios give traders a self-justified reason to defer from their strategies.

Many traders commit to possibilities because the best case scenario solves an emotionally stimulated financial issue such as paying a bill, clearing a mortgage, or changing their living circumstances overnight.

Psychology is a prime reason why traders fail, and the possibility mindset is one of the root causes.

Relying on possibilities is a hidden pitfall converting traders into gamblers. Probable-minded traders avoid this trap because of a key mental difference:

They accept the chance of losing a trade.

Good traders know that every trade has a probability of succeeding. It can be 80% or 30%. They would then trade according to their strategy’s success rate — this means risking appropriately and accepting losses because they can’t win every trade.

Probability-minded traders treat trading like a numbers game 🎲

They’re focused on going through a series of trades to play out their strategy’s win rate. Trading to them is about being consistent over long periods.

On the other hand, possibility-minded traders tend to overfocus on winning a single trade. For them, it just has to win despite the odds being heavily against them.

Possibility-type trades typically have low chances of succeeding (below 10%)…And that isn’t a problem.

It’s only an issue when you behave like trades with a 5% chance of winning has a 95% chance. At this point, traders risk more capital than they should — which eventually blows their account in due time.

It’s like playing the lottery with 70% of the money in your bank account.

A probabilistic mindset is vital to successful trading.

There’s no way around it. And it all starts with figuring out your strategy’s win rate. You need a solid percentage that defines the likelihood of your strategy.

I’ll be honest, the two most ideal ways to get a bulletproof percentage is by:

- Using code to create your strategy and backtest it — a machine won’t fall victim to biases, slight changes, and emotion.

- Experimenting your strategy with real money — it’s only until you trade live that you know if your manual backtests are right or wrong.

Most people can’t code. Backtesting months or years of past data takes time. And nobody wants to lose money on an experiment.

TradrLab is designed to help you craft a solid strategy and make you a probabilistic trader.

You can easily create strategies and use the built-in backtesting engine to test them in minutes.

TradrLab is on its way soon!

In the meantime, check out TradrLab’s intro post to learn more.