Here’s the reality of trading:

Traders are independent variables — the price of a market is affected by the decisions other traders make. Unless you’re Professor X from X-Men, it’s impossible to know things such as:

- How many people will trade today

- What trading decisions people will make

- When traders will pull their money out of the market

Nobody knows this stuff. That gives all trades a completely random outcome.

So how can you consistently profit when trading results are random?

By understanding that trading is a numbers game

Let’s say I flipped a coin and then covered it with a hand. The chance you’ll guess the correct answer is 50%.

But if I flipped a coin 100 times, you’ll be 99% accurate, guessing that 50 landed on heads and the other 50 on tails.

A trading strategy isn’t determined by the outcome of your next trade but by your next 100 trades.

And a successful trading strategy exploits identifiable occurrences that happen in the market.

Put yourself in the mind of a TV store owner.

You don’t know how many people will buy a TV each day and which type they’ll get. It’s random. But you know there’s a spike in TV buying interest on Black Friday. Because you know this, you’ll buy more stock to profit from the motivated buyers.

A good trading strategy takes advantage of the “Black Friday” moments in the market.

Here are four ways to find these moments:

1. Having an Edge on Market Information

This could be knowing:

- When there’s a lot of trading activity.

- The time of day an entity makes a big buy or sell.

- Information that makes a commodity go up or down.

Studying a market extensively grants you access to its secrets.

2. Technical Indicators

Indicators provide a different way to understand what’s going on in the market. Moving averages, for example, create a line chart representing a price’s average change over time. Utilising indicators like a moving average can expose you to things like this:

You can create a strategy where you buy/sell whenever it crosses.

There are also indicators like Heiken Ashi that present a different chart configuration with the intent of identifying trends and reversal points:

3. Market Structure, Candlestick, Volume and Chart Patterns

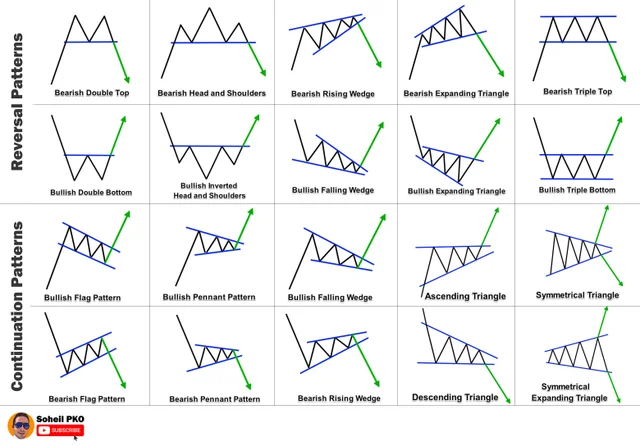

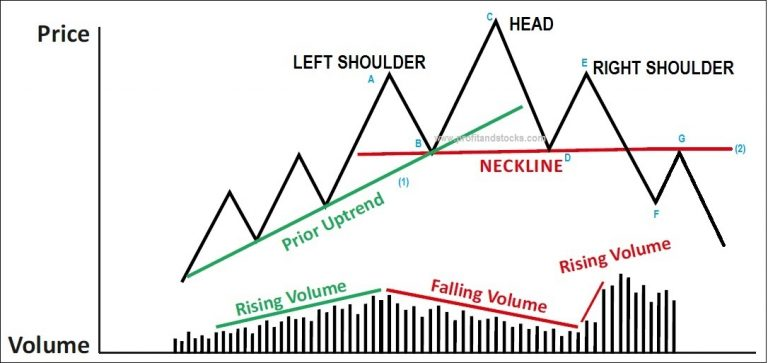

The markets print identifiable patterns like these:

But these patterns have more weight when they are integrated with market structure or volume:

The next step isn’t to trade them but to find out how frequent they appear, a risk-reward ratio that works, and its win rate through backtesting.

You’re profitable if:

- You have more wins than losses with a 1:1 or higher risk-reward

- You have equal or fewer wins than losses but have a high risk-reward ratio that compensates for losses.

A shortcut is to figure out your average profit (gross profit – losses).

4. TradrLab

Many strategies today are outdated because the markets have evolved.

Strategies made 10 years ago are no longer working. Traders aren’t getting away with popular chart patterns or indicators to profit. They have to adapt by creating new strategies for an edge in the market.

Traders today use a combo of chart patterns, market information, and indicators to create a working strategy. It’s rarely just through one avenue.

The issue with building a working strategy today is the time (and money) it takes.

You have to come up with an idea, backtest it against past data, and then try it out in the real markets. Why spend months developing a working strategy when it takes days with TradrLab?

TradrLab is a software where you can quickly build, modify, and test trading strategies.

TradrLab also exposes you to key findings of your strategy, such as the number of setups, average drawdown, average pips gained, and its performance across other trading pairs.

For more information on TradrLab, click here.

In closing, trading results are random, but good strategies make you a winner in the long run.

Remember, a good strategy is about spotting identifiable occurrences in the market. Strategies not based on this put you in the world of trading astrology — a place where a trader’s profit conjuncts with zero.

Many get stuck in the trading gulag for not accepting that it’s a numbers game.

Trades are based on probabilities.

Do enough trades for the probabilities to be in your favour.